CDSL - What & Why

Insights on why CDSL makes a good long term bet

Hello Readers

As you know, CDSL is one of the stocks we added to the long-term portfolio so, in this post, we will try to understand why we are bullish on CDSL for the long term.

Growth is securities market is directly proportional to growth in CDSLWhat is a depository & what’s the role of CDSL?

In India, we have 2 depositories, Central Depositories Services India Ltd. (CDSL) & National Securities Depository Ltd. (NSDL).

The Demat account is just an intermediary and it is actually CDSL and NSDL which hold your shares. So when you open a Demat account to buy shares, the shares are held by the depositories.

NSDL and CDSL difference lies in the following points:

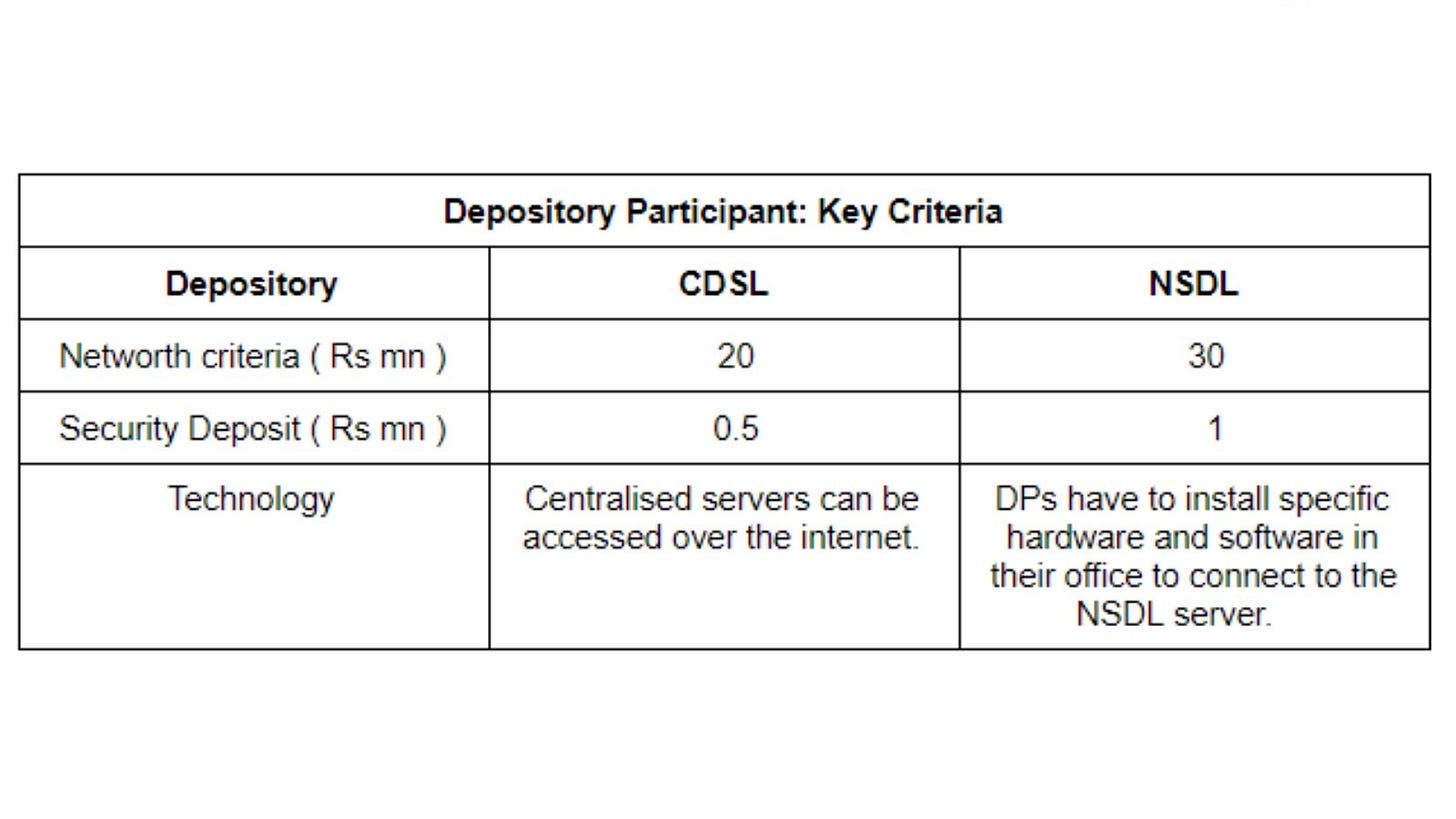

Although CDSL and NSDL are vastly similar, here are some points of difference between CDSL Vs NSDL:

Promoters – One of the key differences in their promoters. BSE is the main promoter of CDSL whereas IDBI Bank, UTI, and NSE are promoters of NSDL.

Stock Exchange – NSDL works for NSE and CDSL works for BSE. Exchanges can use either depository for settlement and trading of securities.

Establishment – NSDL was established in 1996. It was the first depository of India. While CDSL was established in 1999.

Demat Account Format – CDSL Demat account numbers are of 16 numeric digits. NSDL Demat account numbers are alphanumeric and start with ‘IN’ and then 14 digit numeric digits.

Registered Depository Participants – CDSL has 599 registered DPs. But 278 DPs are participants of NSDL.

Investor Accounts – NSDL has 2.25 crore investor accounts. Whereas, CDSL has 3.96 crore active investor accounts as of 30th June 2021.

Why CDSL has an upper edge?

Retail Participation in Indian equity markets < 5%, while Globally > 40%. The surge in retail participation in the equity market would directly benefit CDSL.

CDSL is a go-to place for discount brokers like Zerodha, Upstox, Groww, etc, which have the highest retail investor accounts.

CDSL’s services and eligibility criteria prove to be much appealing to the DPs.